Texas Online Installment Loans From Direct Lenders

Most of us may have faced an urgent need for money at one moment of life or another. The problem with these situations is that they are unpredictable. You need a simple financial solution to help you out of the situation. We can provide these solutions in terms of personal installment loans. This service can be a fast response to unexpected expenses that leave most people stressed.

We understand that you need money in the shortest time possible. Thus, we allow you to apply for the loans online. All you need to do is to log in our site and start the application process. The application process is pretty fast. There are no hassles or bureaucracies associated with other types of loans. You will manage to do it in a few minutes and your money will be wired to your bank account within 24 hours.

Quick Approval Loans – $300 to $25,000 or More For Texas Borrowers

The application only requires personal, employment and financial information. To get the loan, you only need to fill the online application and then wait for the response. This procedure doesn’t involve faxing or any other form of paperwork associated with traditional loans. Just go online and apply for your installment loan with no fax or credit check.

Our number one goal is to protect your information. We are very committed to keeping your personal details confidential. Our website is also designed to protect your transactions from cyber criminals from accessing your information.

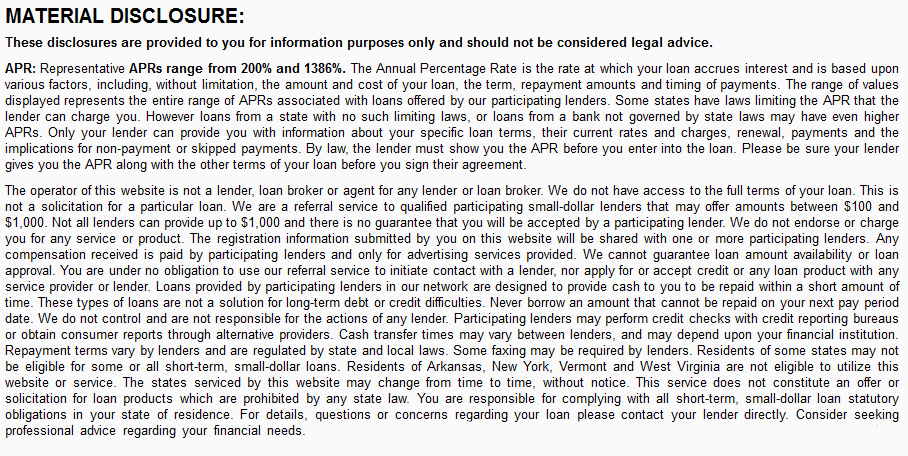

You will be satisfied with the level of our service. Our online installment loans are a great way to borrow money if you need money urgently. The best part with our loans is that we don’t need a good credit history to issue the loans. Our repayment plan is also great, allowing you to easily manage your monthly budget. Our company welcomes any person in need of money. We help our clients to secure loans even with bad loans. It is the best type of loan that you can get to fix your problem in the short time. Apply for the installment loans in Texas today if you are in need of quick money.